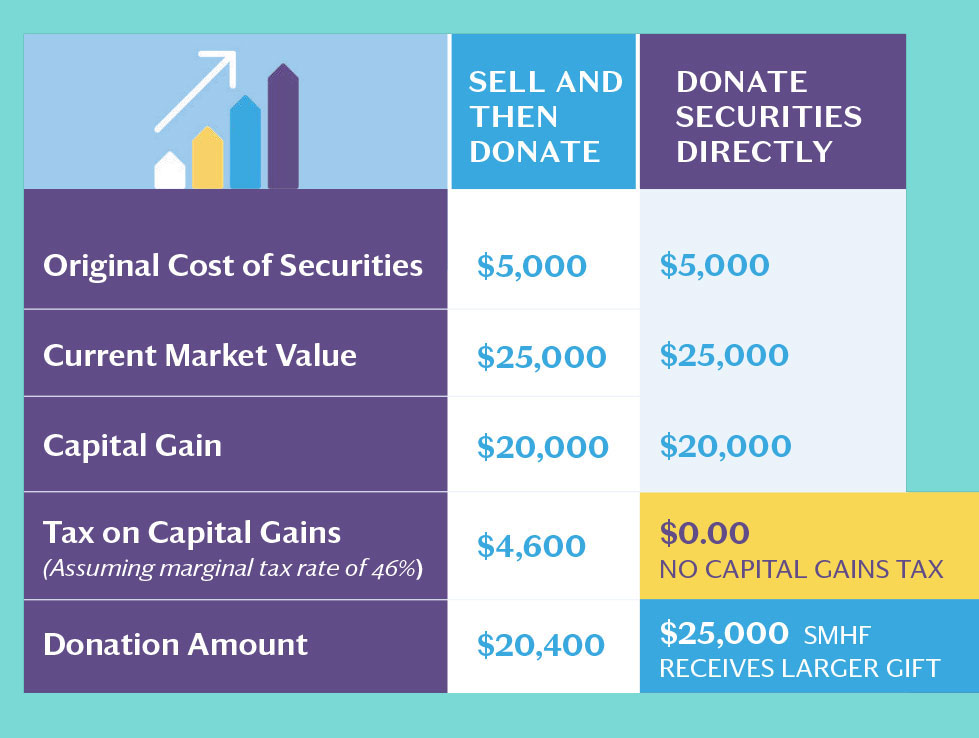

Your best tax advantage for a gift of stock is a direct donation, as the federal government has eliminated the capital gains tax payable on the appreciated value. You or your estate will receive a tax credit to lower the income tax payable.

You can also donate the cash proceeds from the sale of publicly traded stocks, but you’ll have to pay tax on any capital gains so your net tax savings won’t be as high.

For example, under the new taxation rules, if a donor donates stock that originally was purchased for $400 and now has a fair market value of $1,000, the donor will receive a tax receipt from South Muskoka Hospital Foundation for $1,000 and will not have to pay any tax on the gain.